A Model for New Ventures :Feasibility Planning

Just as there are no absolute answers on how to succeed in business, there are no absolute answers on how to develop a successful new venture. There are no undisputed "models" of entrepreneurship, but there are similarities among the leading ones that suggest a paradigm, a general pattern of how to progress from an abstract idea to achieving sustained sales. This chapter provides a paradigm in which the sequence of activities starts with the initial idea and ends with an established enterprise positioned for growth.

The model, or paradigm, encompasses a feasibility plan. This is a pragmatic business plan reflecting the philosophy that entrepreneurs should do the planning necessary to ensure the feasibility of a venture without becoming overwhelmed in the process.

THE CONCEPT OF A PLANNING PARADIGM

Karl H. Vesper, a leading educator in the field, concludes that there are perhaps a half dozen leading models that describe the entrepreneurship process. He also notes that these models suggest more than a hundred different sequences for creating new ventures, each sequence having variations according to the unique characteristics of individual ventures. As a result, entrepreneurs can follow one paradigm only with the understanding that it provides a framework-not a mandate-for required activities. This point is illustrated by the experiences of two successful entrepreneurs who established their businesses through entirely different sequences of events.

Called the Cowboy Capitalist, H. Ross Perot, founder of Electronic Data Systems Corporation (EDS), may be one of this century's most unpredictable and successful entrepreneurs. Perot started EDS in 1962 with $ 1 000 and an idea for using computers as integrated systems. He envisioned computer terminals connected ough telecommunication systems and information processing that could link operations instantaneously on a global basis. We take these things for granted today, but they were revolutionary in 1962, when critical technology such as integrated, circuitry, microcomputers, and telecommunication software were years away from being developed. Nevertheless, Perot had ttie vision, and he created EDS to accomplish the feat. Planning was incremental, starting with systems designed for office use, expanding to factory controls, then to company wide integration. Perot hired the best designers and planners possible, established a remarkable market research team, and focused EDS always on possibilities five or ten years into the future. Perot relied on instinct but made informed decisions based on astute strategic plans developed by his staff. As a result, EDS was compared to a tank that could be put into low gear and roll over anything. The company was sold to General Motors in 1984, but Perot is doing it all again with Perot Systems, and looking into the next century as a planning horizon.

In contrast to Perot, Michael Dell began as a premed undergraduate student who, at the age of 20, turned a hunch into the quarter-billion-dollar Dell Computer Corporation. The hunch came to him while working part-time selling IBM PCs near his campus. Through his job, he discovered the huge price markups on computers, and he was convinced that the world was ready for a low-cost "clone" of the IBM PC. To test his idea, he assembled his own PC in his apartment from parts purchased by mail order. It worked, and the total cost was weil under $1,000, so he made a few more to sell to friends. The hunch turned into a business, and he called his system the PC Limited. Word spread about Dell's computers, and he began taking orders over the phone. Demand was extraordinary, and his apartment-based business soon turned into a direct sales organization. Planning evolved only as sales growth pushed Dell to make decisions, but his success formula was entrenched by circumstances; build a clone computer at the lowest cost possible and market it directly through an army of salespeople with telephones. Planning became essential to establish purchasing systems and a nationwide distribution system, but planning was done reluctantly process. Nevertheless, it was accomplished by dedicated staff, and the corporation expanded to more than $200 million in sales. Although many of his ideas changed as the business evolved, Dell retained the core strategy of direct sales and low-cost clones.

H. Ross Perot and Michael Dell represent two ends of a spectrum of planning activities, and their businesses evolved through entirely different sets of sequential activities. There is noway to say whether either would have been more or less

The Four-stage Growth Model

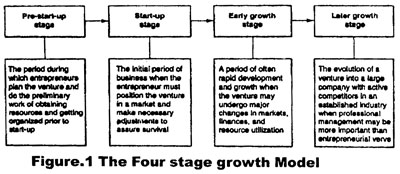

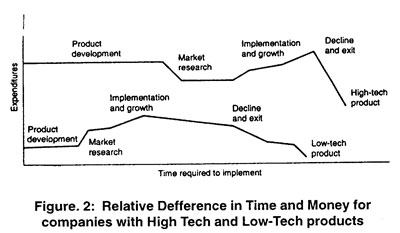

The four-stage growth model consists of categories of distinct activities essential for a new venture to progress from an idea to a substantial enterprise. The four are pre-start-up, start-up, early growth, and later growth stages. Figure 1 summarizes activities related to each stage.

Pre-start-up Stage

During this initial phase, ideas evolve from a creative process to the point of being consciously perceived as commercial endeavors. Entrepreneurs have already begun to believe that their ideas are feasible, and they become fascinated by visions of their enterprises. As noted earlier, many of them will haphazardly plunge into business, following a popular adage that entrepreneurship is simply a manner of "finding a gap and filling it."

More astute entrepreneurs will begin by asking questions about the actual potential of their products or services. They will try to answer questions about production, operations, markets, competitors, costs, financing, and potential profits. And they will try to resolve questions about their own abilities to start businesses.

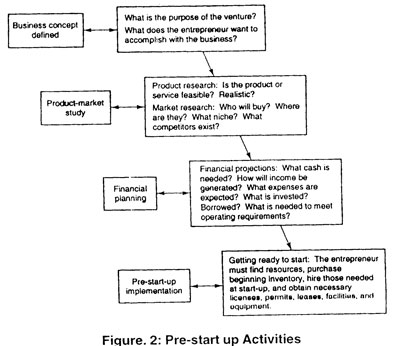

Depending on the complexity of the proposed enterprise, the range of pre-start-up activities can be quite extensive, but there are four activities common to all new ventures. These are shown in Figure-2.

Business Concept Identified. Entrepreneurs must first conceptualize their businesses. This conceptualization may occur as a natural extension of the creativity process in which new ideas

are shaped into visions of useful products or services. It also may occur in a conscientious plan developed around a perceived "gap" that an entrepreneur might "fill." The critical question to be answered is "What do I want to accomplish with this enterprise?"

To illustrate the point, consider how Steve Kirsch developed the concept for his electronic "mouse," a common accessory today for computer systems. Kirsch was an MIT student working in a computer lab where three very expensive machines were all crippled because the mechanical mouse each machine used was broken. He said that it was a sad situation, "like having a Ferrari with only three wheels on it. Kirsch set about designing a reliable electronic, mouse, formed his company, Mouse Systems, Inc., in 1982, and now has clients, that include most major manufacturers of microcomputers and scientific workstations. He had no preconceived notion of becoming an entrepreneur, but the idea "glared out at him" when he built a reliable mouse for himself The idea of a business evolved over a period of several months when he realized the market potential. Kirsch's innovation was not his-business concept; he could have sold or licensed the idea to IBM. Kirsch chose to subcontract production, create a marketing company, and position his business to sell mouse accessories. His business concept was to design and market high-quality mouse accessories at premium prices.

Many rapid-fire questions jump into an aspiring entrepreneur's head the moment an idea begins to take shape. A few of the important questions are these: Does this thing exist already? If it doesn't, can it be made? Who would buy it? Why would they want it? Where are these customers? Am I the person to make this thing? Am I the one to sell it? Anyway, why would I want to do this?

T'he business concept may not be fully developed until most of these questions are answered. For instance, Kirsch initially had no intention of establishing his own venture; he wanted to sell the mouse design. When he was turned down, he offered to license his product. Turned down again, he thought of manufacturing, but realizing that he knew very little about production, he decided to focus on designing and marketing mouse accessories.

Product-Market Study. Once an entrepreneur has determined that a product or service is feasible, and that he or she might be capable, the next set of activities involves pragmatic research. This is crucial because entrepreneurs often jump to early conclusions based on intuition that, under close scrutiny, reveal fatal flaws in their plans. Research is necessary in at least two areas: product development and marketing.

Product research should include patent searches to uncover existing products. It is not unusual for dreams to end in the U.S. Patent Office when a half dozen similar product ideas are discovered. Some may be in production, some may be registered but never brought to market, and some may have never worked in the first place. If the search reveals a similar product in production, the proposed new venture usually ends there. If a product was patented but was also a commercial failure, understanding what went wrong could help avoid similar mistakes. It may be necessary to contact the original inventor, talk with the company that riade the item, or search for out of circulation products in closets. If the product never worked in the first place, its flaw might be discovered, encouraging the entrepreneur to design a successful one.

Product research also requires actual R&D to design the item, investigate development costs, evaluate materials, a/id explore, methods of manufacture. The questions to answer include the following: Can it be done? Can it be done at a cost that could generate profits? How is it to be done? Who will do it? As we shall see later, these questions are addressed in a special section of the feasibility plan, but product research must be initiated during the pre-start-up stage.

If the business is concerned with services, such as setting up a travel agency, "product" research in the sense of technical R&D does not exist. However, a travel agency will delineate its range of services, including types of tours offered, destinations, airlines served, travel associations with which to affiliate, and so on. This range of services defines "products" for the travel agency, and the business concept will depend critically on the blend of travel services devised through pre-start-up planning. Similarly, a retail merchandiser must define an inventory plan. This will devise the store's business concept through its product line, cost structure, image, and merchandising strategy.

Market research is the process of answering such questions as these: Who will buy the product or service? What will they be willing to pay? How can I attract them to my business? If this venture is a big success, what will prevent competitors from overwhelming me? Who are my competitors? Can I establish a niche in the market? What are my options for long-term growth? These questions are critical to pursue in concert with product research efforts for several important reasons. First, the product itself is usually modified by feedback from initial market research. Second how a product is marketed often determines how it is designed, manufactured, and packaged. Third, a product is often commercially viable only when markets can be protected against strong competitors.

The initial stage of marketing research is often rudimentary. Typically, entrepreneurs will confide in close friends or family members to get reactions to their ideas. This feedback is useful but often misleading. Friends and family members seldom want to hurt the feelings of someone close, so feedback is often a cautious nod of approval rather than an objective evaluation. Then too, there is the chance of caustic rejection-again, often without objective evaluation. Ted Turner's father, an entrepreneur himself in the advertising business, seldom found anything worthwhile in his son's ideas. Father-and-son arguments between the Turners were notorious father wanting son to "do something useful" with his life, and son wanting to "do something different.

Entrepreneurs occasionally seek professional help from market researchers, university centers, and experienced mentors. Unfortunately, most entrepreneurs do not ask enough people enough questions. They seldom ask customers for their opinions, yet when they do, they often gain valuable insights about their ideas. Successful entrepreneurs will try to reach 'as many people as possible in a systematic manner before making start-up investments. Formal market research, however, can be complicated and expensive, so during the pre-start-up stage, the process is usually informal. Specifically, entrepreneurs will personally research industry data, study competitors, and seek advice from people they know and trust.

During pre-start-up planning, informal market research is a minimum requirement. Entrepreneurs must be able to find satisfactory answers about their potential markets and competitors. They also must have some reasonable idea about pricing, promotions, and distribution.

Financial Planning. The third set of pre-start-up activities relates to money. Although new ventures are usually underwritten by personal savings and cookie-jar money, cash infusions are needed as the business begins to grow. Early cash flow is usually acquired through a combination of short-term loans, home mortgages, and family investments. As the venture evolves further, more cash is needed, and entrepreneurs have to attract capital through sophisticated loans and knowledgeable investors. Attracting capital requires careful planning and documentation about products, services, markets, and the entrepreneur's expectations.

Financial planning during the pre-start-up stage will not necessarily be extensive, but it does have to be based on verifiable information. For example, if an entrepreneur projects a million dollars in sales during the first year, there should be more than intuition behind the forecast. Using product and market information, the entrepreneurshould be able to justify cost-price relationships, how sales were estimated, and what will be required in overhead expenses. Using this information, the entrepreneur can forecast profits and cash flow, the two major pieces of information required by bank loan officers and investors.

The type of capital needed will dictate requirements for financial documentation. Most ventures will need seed capital during the pre-start-up and start-up phases. Seed capital is the cash needed for product development, market research, and initial operating expenses before sales revenue can begin to offset business expenses.

During the pre-start-up stage, entrepreneurs seldom need extensive seed capital, with one exception: When the nature of the business is to create new products through research, the venture may spend years in development without creating anything to sell. As a result, an infusion of substantial capital is needed that far exceeds the concept of seed money. The biotechnology industry exemplifies this phenomenon. Genentech, Inc., a biotech company that manufactures lab testing enzymes and experimental medicines, spent more than three years and $20 million before announcing its first commercial product.

If we stay with a general model of a simple business, financial planning activities are not complicated during the pre-start-up stage, but they require diligence. Investors and lenders want to see financial projections based on reasonable initial research, and .they require accurate documentation. They also require financial statements that show how the venture will perform during its first few years of business. Entrepreneurs also will have to clarify their stake in the business, investments by family members or partners, and their personal financial capabilities outside business interests.

Pre-start-up Implementation. If we define the pre-start-up stage as a period that precedes any attempt to generate sales, then it is a stage similar to that of an Olympic sprinter preparing for a race. The sprinter, like the entrepreneur, plans, trains, develops strategies, and gets physically and mentally prepared to run. Just before the race is to begin, the sprinter gets into the starting blocks to await the gun. Like the sprinter, an entrepreneur must commit to action and do certain things before the event.

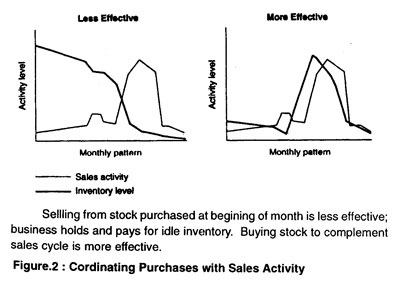

Entrepreneurs must establish vendor relations with suppliers, establish a business location, hire essential personnel, arrange for initial promotions, and set up administration systems. These activities vary widely with the nature of the business, but they are all essential. If the venture is a new retail store, the premises will have to be leased and renovated (or perhaps a store built). The store will need starting inventory, so advanced purchasing must be accomplished. Sales clerks may be needed on opening day; therefore, they must be hired and trained. Public relations, advertising, and a grand-opening event should be arranged. Finally, administrative systems must be in place, including inventory and cash controls, credit card subscriptions,a merchandise replenishment system, and a payroll system.

If the business is in manufacturing, the pre-start-up stage is much more complex. It will include those activities already noted plus equipment leases (or purchases), performance checks on equipment, engineering, and initial production of starting inventory. In addition.marketing systems must be in place, and the entrepreneur may have to comply with regulations by agencies such as the Food and Drug Administration, Environmental Protection Agency, Equal Employment Opportunity Commission, or Occupational Safety and Health Administration.Service ventures, such as restaurants and realtors, must comply with state and local licensing laws. Attorneys, public accountants, physicians, and other professionals will have to meet criteria established by regulatory agencies and professional licensing associations.

These activities are best accomplished well in advance of opening, not at the eleventh hour; however, some things may be postponed until the last minute. These include signing leases and hiring employees, because they create expenses that cannot be recovered until the firm begins generating revenue.Therefore, the pre-start-up implementation phase constitutes a set of well-timed activities that must be accomplished.The entrepreneur is stepping into the sprinter's racing blocks.

Start-up Stage

The start-up stage is the initial period of business.For companies with products or services to sell, it is the first foray into revenue-generating activity.The start-up stage has no definite time frame, and there are no models to describe what a business does during this stage; however, there are two benchmark considerations. First, entrepreneurs want to meet operating objectives, such as satisfying revenue and cost targets. Second, they want to position the venture for long term growth. These objectives are summarized in Exhibit.1

Exhibit! Start-up Operating Objectives

| Sales |

To attain monthly sales volume as projected at prices projected in feasibility plan. To achieve projected sales mix of products and services as summarized in feasibility plan. |

| Revenue |

To achieve cash flow within budget based on sale volume and price projections. To meet targets above variable costs with appropriate operating margins. |

| Growth |

To realize incremental growth within seasonal pattern of forecasts. To maintain balance of growth with ability to underwrite inventory, materials, and human resources. |

| Position |

To solidify a long-term position in appropriate markets as a result of adaptation during start-up. To identify marlict strategy for niches oropportunities in new products, services, ormarkets during start-up. |

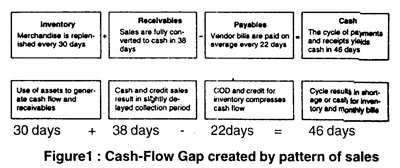

Meeting Operating Objectives. Ideally, the venture will generate projected sales, or do slightly better. If sales are significantly below projections, the venture risks running out of cash and closing. If sales are substantially higher than projections, the firm may find itself equally in distress and unable to either finance growth or replenish inventory.This risk is often overlooked because most people automatically assume that a higher sales volume means higher profits. Unfortunately, the only time this assumption is true is when an entrepreneur sells everything for cash and has an unlimited supply of inventory. Both conditions are rare.

More often, a business has an established inventory that requires time to replace and cash to acquire. If the business sets records on opening day, it may have nothing to sell on day two. One answer to this dilemma is to buy more inventory through rush orders, paying a premium for goods.If the company has large margins, added costs may be easily absorbed, but usually it is the other way around-premium costs absorb cash and profits.

This process is precisely what happened to Osbome Computers. During its first year of operations, Osborne became the fastest-growing corporation in the United States. The company's founders had conceived of the first portable computer in 1980, several years before Compaq and IBM did so, but they had estimated sales at less than a third of the $80 million in orders achieved during the first few months in business. Because most sales were to distributors who had 30-day credit terms, Osborne accumulated huge orders, but without cash receipts. The company acquired debt financing to meet manufacturing costs, shipped computers around the clock, and within a few months was hopelessly in debt. Creditors called in Osbome's debts, and investors quickly liquidated, leaving the company debt ridden but with extraordinary sales orders. Unfortunately, orders could not be filled.

Meeting operating objectives does not necessarily mean making a profit. To the contrary, most new ventures operate at a loss for several years.They "break even" only with carefully monitored controls, but they should be able to structure the business so that variable costs are covered and cash flow\s positive. If either condition cannot be met, the enterprise is not viable. Specifically, when variable costs cannot be met by sales revenue, by definition the company will go deeper into a hole with each sale. In addition, there will be no income to contribute to fixed costs or pre-start-up expenditures.

Maintaining a profitable blend of products and services is also important. For example, a retail bicycle shop may have been planned to generate 60 percent of gross revenue from bicycle sales, 30 percent from accessories, and 10 percent from repairs. It may turn out that 60 percent of total revenue is derived from accessories, 30 percent from bicycles, and 10 percent from repairs. In this situation, the shop owner will have idle inventory in bikes (money tied up in slow-nioving inventory) while accessory inventory is depleted. Moreover, unless the cost-price differential is exactly the same for bicycles and accessories, income projections will be seriously distorted.This sequence of events is precisely what happened to Spokes Etc.a bicycle shop located in Alexandria, Virginia. Fortunately the store's owner, Jim Strang. recognized the shift in sales early, quickly adjusted his operations,^and avoided catastrophe. Good pre-start-up planning helps reduce these problems.

PROFILE

Jim Strang

With two locations in northern Virginia, Spokes Etc. is a successful bicycle business founded by Jim Strang, a 1985 college graduate who spent his first two years after earning his business degree in the fast-paced world of corporate sales for Lanier Corporation. Life in the fast lane lost its luster when Strang had to give up biking and his independence, however, he enjoyed the challenge of business and sales. By opening his own bicyle shop. He satisfied his disire to stay close to biking and to pursue a business carrer. His bicycle stores have the latest equipment accessories, and clothes, and he has a team of mechanics who share his enthusiasm for biking. Everyone in Spokes Etc. is a competitive rider and eager to share their knowledge with customers. In Strang's view, the business is a "living, personal extension of our philosophy to have tun and help others have tun. It' we grow any larger, that could get lost in the shuttle.... I like it the way it is."

Positioning the Enterprise. Every successful business starts with a preconceived business idea. As noted earlier, this includes a concept of the product or service, markets, and growth potential. Entrepreneurs often find, however, that reality is quite different from what was envisioned. Two considerations are important. First, the business must survive in the short run. and second, the business must be positioned'to achieve long-term objectives.

From a survival viewpoint, the start-up stage is a crucial period when adjustments are made. The entrepreneur who "opens" and smugly waits for sales to occur may not be open for long. Needless to say, some enterprises are so well developed before opening day that customers are lined up with cash in hand. This is not usually the case, more often this stage is a period of acid tests when many things go wrong. The product simply may not work, not sell be introduced at the wrong time or be positioned in the wrong market. The entrepreneur may not be capable of'running the business. Costs may exceed expectations. Prices may not be low enough to attract customers.lnvestors may back out. And so on. Consequently, entrepreneurs must make quick adjustments to survive. These may include simple decisions such as adjusting inventory to eliminate slow-moving items, or complex decisions such as restructuring the company's debt when cash flow becomes thin.

From a long-term perspective, the business concept must coincide with realistic prospects for growth. This means that the enterprise must be positioned to take advantage of growth markets. Products are positioned by placing them for sale in particular market niches, For example, Michael Dell positioned PC limited to sell to small businesses and as stand alone systems through a factory direct marketing process. He could have positioned his products for home use, education, scientific work, or office networks, each with different distribution systems. Other companies are positioned in these markets. Sun Microsystems, for example, sells mainly to organizations with engineering applications, Hewlett-Packard is strong in scientific research, and Apple Computer is strong in education markets.

Positioning of services is the process of organizing the enterprise to provide expertise to a particular clientele. Hyatt Legal Services, a consortium of independent attorneys, targets family clients with services that include drafting of wills, handling probates, representing clients in divorce suits, and litigating casualty claims. Other attorneys will specialize in criminal law, patents, corporate legal services, or labor relations. Retailers can finely tune their markets for young professionals, married women, single men, children, wealthy clientele, bargain hunters, and so on. Ideally, positioning will be planned during the pre-start-up stage, but even the best plans change soon after the venture opens, and positioning-or repositioning-is essential.

Early Growth Stage

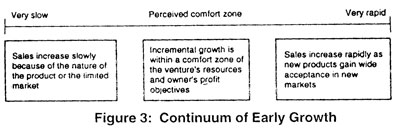

Once the venture is positioned, successful enterprises will experience a stage of early growth. This is a period of intense monitoring, and growth can occur at different rates along a long continuum, ranging from slow growth through incrementally higher sales to explosive growth through quantum changes in consumer demand. This continuum is illustrated in Figure 3.

At the low end of the continuum, entrepreneurs find that they compete in slowgrowth markets. New parcel-delivery systems and mail outlets such as the franchised Mail Boxes Etc. are successful, but they compete in local markets against UPS^Federal Express, and the U.S. Postal Service. As a result, they can achieve immediate success by attracting clients who seek alternative mail services, but annual growth rates are typically less than 5 percent because each store must persuade new customers to change their methods of handling mail. Most highly specialized businesses, particularly those in food and agriculture ' will experience slow growth. These include cheese shops, specialty garden farms, dietary consulting, ecology research, organically grown wines and vegetables, and specialty foods like tofu.

At the high end of the continuum, two companies that experienced high-growth sales were Osbome Computers and People Express Airlines. As noted earlier, Osborne grew so rapidly that it outran its ability to finance expansion. People Express, once listed as the nation's fastest growing company, also outran its underwriting. Plagued by high expenses and a huge debt burden for aircraft, People Express filed for bankruptcy protection in 1987. however, there is nothing wrong with rapid growth as long as it is managed. For example, Karsten Solheim, a Norwegian immigrant, developed his first Ping putter as a hobby while working for General Electric. He positioned Karsten Manufacturing Corporation to manufacture a full line of golf clubs during the early 1980s when demand for golf equipment was expected to increase exponentially with rapid growth in new courses. Karsten's firm grew at nearly 200 percent annually, and by 1989, Karsten's Ping clubs were leading the mirket; Ping putters were used by more than half of PGA touring pros. Today, Ping produces 12,000 clubs a day, grossing $ 1 00 million annually without being able to meet demand for customer orders.

Between these extremes, a majority of entrepreneurs find a "comfort zone" of expansion. Their ventures may have growth potential, but founders restrain expansion to coincide with personal objectives. Jim Strang, founder of Spokes Etc., quickly succeeded in his first bicycle store, and within a year he opened a second store. Both stores are successful, with annual growth near 20 percent. In 1989, Strang was urged to open a chain of franchises but refused, preferring instead to own and control his own shops. At the same time, Garry Snook founded Performance, Inc., a bicycle business with inventory similar to strang's. Snook, however, decided to pursue rapid growth. He leveraged the business, created a franchise system, and by 1989 had ten stores in four states and more than $40 million in sales. Snook's business is growing more rapidly than Strang's, but not at the frantic pace set by Osbome or People Express. The important point is that both Strang and Snook are meeting their personal objectives, staying within their "comfort zones."

Interesting things can happen to a new venture during this stage. If the entrepreneur has a unique product or lucrative patent, the business may be actively courted by larger firms. Such courtships can result in very profitable buyouts or licensing agreements. Mergers are also common, as companies with complementary strengths combine to form a new company positioned for more rapid growth. Many businesses also experience early growth but find that the enterprise has severe limitations. In this case, an entrepreneur may simply recognize that the future holds little growth potential and reposition the venture as a small business.

Later Growth Stage

It the enterprise proves successful in the early growth stage and has momentum.it can find itself in competition with larger companies. This is the later growth stage, when the rate of growth may be slower and the industry has attracted competitors Companies reaching this stage often "go public" with stock offerings. Family fortunes turn into corporate equity positions, private investors convert their holdings into publicly traded securities and management teams replace the entrepreneurial cadre. In many instances, founders lose the personal identity they had with their firms, and it they are not ready to adapt to corporate management, they leave (or are ousted). Those who do adapt enjoy the benefits of corporate management and the profits of being major stockholders. For example, Jim Jaeger, founder of Cincinnati Microwave, Inc., the company that makes the Escort radar detector, reached a sales plateau in 1984. The market was still strong for radar detectors, but competition required infusions of rjew products. He developed a complementary product called the Passport, and sales surged. Jaegerfound himself heading a $17 million company with hundreds of employees. This growth required a transformation in the company to restructure its equity capital and to establish a professional management team. Jaeger accomplished both, and his company continues to prosper.

A few ventures become farge without losing control or going public. Their founders continue to manage their corporations, finance growth through earnings, and avoid the complexities of publicly traded stock. The Du Pont family controlled its chemicals and plastics empire for generations, and today, the Mars family still owns and manages its global company in candy and convenience foods. Perhaps one of the most interesting companies is Mrs. Fields Cookies, a company started in 1978 by Debbi Fields at the age of 22, and now jointly operated by Debbi and Randy Fields. Their business has more than 500 stores spanning five countries and grosses $100 million annually. The business is not franchised; all stores are owned by the company, which is managed by a staff of about 120 people.

Understanding the Four-Stage Growth Paradigm

Sequential stages of new venture development represent intervals that focus on different sets of circumstances. During the pre-start-up stage, the focus is on product, service, and market planning. The start-up stage requires entrepreneurs to focus on implementation and early positioning. During the early growth stage, they are concerned with rapid changes in. sales and resources. And during the later growth stage, they must make a successful transition from personally managed enterprises to professionally managed companies.

Few companies, however, experience all four stages of growth. As noted earlier, many new ventures simply do not survive long enough to continue past the start-up stage. Others will be started by entrepreneurs who have no intention of expanding beyond a "comfort zone" of operations. Still others will embrace rapid growth but then founders may not be able to make the transition to professionally managed companies.

The feasibility planning scenario presented in the following pages focuses on the pre-start-up stages. In the process we address implications for the early growth stage but palnning for the lates growth stage is omitted as a topic more appropriate for management and business policy courses.

FUNDAMENTALS OF A FEASIBILITY PANS

The term feasibility planning is uses as a way of moderating the concept of a comprehensive business plan. A feasibility plan encompasses the full range of business planning activities, but it seldom requires the depth of search or detail expected for an established enterprise.

.

Every new business is unique. Each will have somthing that sets it apart from others, even if it is no more than the personality of an entrepreneur. For that reason, no plan is going to provide an absolute prescription for success. A feasibility plan is on an outline of potential issues to address and a set of guidelines to help an entrepreneur make better decisions.

Developing a Good Plan

Feasibility plans usually are written for investors and lenders, and being aware of this audience often leads to overoptimistic presentations by entrepreneurs who "hard sell" their business concepts. Occasionally this tactic may attract investors and help secure loans, but it will have little value as a management tool for the founder. Writing an honestplan with tyeW-supportec/information will benefit everyone.

A well-written plan should be succinct, clearly identifying products, services, markets, and the founders. A feasibility plan does not have to be "slick." but it does have to be prepared in a quality manner. The plan should be easy to read, complete, and accurate. There should be no misspellings, improper grammar, or mistakes in data. Effective plans avoid emotion-packed phrases like "This can't miss!" or "Everybody needs this!" They also avoid abstract language. Entrepreneurs who know how to write a good plan will avoid saying they "think" there is a market or they "believe" a product will work. Instead, they will use facts to support their assertions.

The Product Concept and Commercial Opportunities

Historically, entrepreneurship has been associated with new products and extraordinary inventors. Most students, however, think less about new products, and more about new products, and business education is preoccupied with service careers. Consequently, little attention is given product concept or opportunities in nufacturing. This lack of attention is unfortunate because even in our so-called post industrial economy, it is a strong industrial sector that drives the nation forward. In this chapter, we present the argument for manufacturing as the cornerstone for technological innovation and significant entrepreneurial activity.

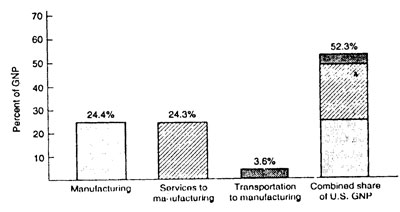

As we shall see, U.S. manufacturers directly employ slightly more than a quarter of the total work force, and indirectly support an equal, number of service jobs dependent on manufacturing. Manufacturing accounts for 52 percent of non farm annual GNP. without any evidence ot'decline But this statistic does not necessarily mean that half of the American economy is embedded in cavernous smoke-filled factories or that services are any less important to a vibrant economy. The nation has changed, and what has changed is how work is performed, along with the technologies used to create a rewarkable array of exciting new products. Industrialized nations, and the United States in particular, have experienced a metamorphosis away from "labor-intensive production" to information-age technology." This transformation was bom of creative entrepreneurship, and the future promises tremendous opportunities for even greater entrepreneurial efforts as more new products, new technologies, and new services evolve.

Following our discussion of in macro trends in product development, we will focus on micro issues of product innovation, opportunities foi new products, and com-mercialization of new products.

A MACRO VIEW-MANUFACTURING MATTERS

To better understand our current and future opportunities, it is important to recognize how important manufacturing is to a nation's wealth and power. More important, it is essential to recognize that the United States is not shifting out of manufacturing into services. The so-called post industrial economy is a myth. Evidence for this conclusion is found in major research studies encompassing economic activity from World War II to the present day, in which contributions to gross national product by manufacturing have remained fairly constant between 47 and 53 percent of total goods and services in the United States.

Unfortunately, many of these studies have been misinterpreted (or ignored), and a popular image has emerged in the United States that manufacturing is in a serious; decline. Reports in the popular press indicate that today less than 18 percent of direct employment is in manufacturing and that only 24 percent of GNP is created through goods-producing industries. The same reports compare current trends in manufacturing with agricultural trends 50 years ago, and both are labeled shifts in the economy.

Specifically, agriculture currently employs only 3 percent of the work force, whereas in 1946 the figure was about 14 percent, and in 1920, about 21 percent. Using the same criteria, manufacturing employed 37 percent of the work force in 1953, currently about half that number, and fewer workers will be employed in manufacturing in the future.

The crucial point is that these pessimistic data are correct, but they measure only direct laborin manufacturing finished-goods products and direct Value added'in those finished goods.The data do not account for inputs (materials, technology, energy ' transportation, and services) required "up stream" by suppliers to final goods manufacturers or "downstream" by those who distribute and sell manufactured products. A similar argument can be made for agriculture, recognizing that food processing, food products manufacturing, packaging, and distributing are all part of a more comprehensive picture of agriculture. Giant corporations such as General Foods, Kraft, Campbell's, Sara Lee, and Kellogg's are quite obviously linked to agriculture but counted "economically" elsewhere.

Clarifying the Role of Manufacturing

Using popular data that report only the value of finished goods added directly by manufacturing, the U.S. manufacturing sector contributes o/rectfyabout 24 percent of GNP annually, and this share has been fairly stable, rising slightly during the past four decades with occasional recessionary periods when steel or automotive industries have suffered setbacks. Add to that the direct share of 24 percent of GNP that originates in services that are inputs,to manufacturing, and the direct share of 4 percent GNP that originates in transportation as an input to manufacturing, and a realistic annual contribution estimated by the manufacturing sector is 52 percent.

Estimates of the manufacturing sector's contribution could be much higher if energy used in production and finished goods transportation were included. Consequently, we can be easily misled into thinking that the United States is headed toward a service economy. In fact, if that transformation would ever occur, the United States could lose its status as a major economic power. Specifically, if American manufacturing dissolved (or moved "offshore"), those services, energy resources, and transportation systems currently separated as "nonmanufacturing" would also dissolve (or move offshore).

Consider what might happen if General Motors no longer produced cars domestically but instead moved all manufacturing to Taiwan or Korea. Jobs would go overseas, energy used in production would be supplied overseas, most raw materials would be purchased overseas, and a majority of support services would migrate to the production location. Domestic railroads and truck fleets would no longer be needed to transport raw materials, parts, tools, subassemblies, or machinery. Tightly linked "downstream" enterprises such as car dealers and fleet merchandisers would become importers. Loosely linked "upstream" enterprises like advertising agencies would be working for a foreign-located (and possibly foreign-owned) company. Envision how a mass exodus of manufacturing would ripple through the economy. Even the financing and insurance required for offshore or overseas production would be provided by foreign enterprises, or by other U.S. companies that have moved overseas.

What the continuing importance of manufacturing means for the aspiring entrepreneur is that, first, new products will continue to be the arteries of wealth and, second, that suppliers of parts and services closely linked to new products will be among the best opportunities for high-growth enterprises. On the downside, it also means that suppliers and services closely linked to manufacturers that are moving offshore will suffer, and subcontractors who supply other manufacturers will be at the mercy of global developments by transnational corporations that increase their foreign interests.

The Productivity Shift

As noted earlier, popular themes relate how America "shifted" out of agriculture and into manufacturing and now is "shifting" out of manufacturing and into postindustrial services. In truth, neither shift occurred. In agriculture, a technological revolution made it possible not on y to feed a rapidly expanding American population but also to grow surpluses for export with fewer and fewer people directly involved in agricultural jobs. In manufacturing, a technological revolution is taking place with parallel implications.

The Agricultural Perspective. The productivity change in agriculture began when Cyrus McCormick introduced his mechanical reaper in 1831.

PROFILE A

Norman Borlaug-Nobel Peace Prize Laureate As an Iowa farm boy, Norman Borlaug dreamed of improving the way wheat farmers lived. He recognized that farmers barely made a living, and a harsh one at that, scratching a profitable harvest from the soil each year. The problem was that wheat and grain yields after World War II were low, and although there was a world shortage of food, crops were often devastated by floods or droughts.The answer was to improve productivity through new food products that could withstand nature's challenges and also provide greater profits to farmers as incentives to produce more food.

Borlaug became a trailblazer in agricultural productivity research, and he was instrumental in developing hundreds of vigorous strains of grains that could withstand harsh growing conditions. Borlaug created a green revolution by spreading his findings worldwide, particularly to underdeveloped countries, providing the means for bountiful yields, often in places where food grains had never been successfully planted. For his work, the Swedish Academy awarded Borlaug the Nobel Peace Prize in 1970, citing the continued importance of food production in a global community of nations, many still ravaged by starvation.

A further change occurred when Gustavus Swift introduced systematic meat and food processing in the late 1800s. He also invented the refrigerated railcar that made rapid transportation of meat between Chicago and New York possible. As World War I came to a close, Campbell Soup, Heinz, Kellogg's, Kraft, General Mills, and Pillsbury, among many others, emerged as fast-growing companies with new technologies for harvesting, processing ' packaging, and delivering foods.

Many entrepreneurs emerged during the depression of the 1930s and prospered through innovative methods of growing grains and vegetables. Few of these entrepreneurs have gained the same recognition as modem folk heroes, but their contributions have been impressive. For example, J. R. Simplot, a potato farmer at the beginning of the Great Depression is today a billionaire who heads a multifaceted company based largely on fanning and food processing. Simplot devised a way to improve potato yields by 250 percent, then developed the technology to process potatoes, reducing costs by 50 percent. By World War II, he had found a way to quick-freeze french fries, and subsequently became the major supplier of prepackaged french fries to both the U.S. Armed Forces and McDonald's Corporation. Another change occured cuffed during the early 1950s, when 40 new strains of grain were developed, and the agronomy research industry emerged to increase food production by nearly 300 percent over the next two decades.This increase was due in no small way to Norman Borlaug, an Iowa farmer who became a leading researcher in grains.Borlaug developed several of tile first strains of high-yield food grains that could withstand extremely harsh conditions, and in 1970 he was awarded the Nobel Peace Prize for introducing these products on a global scale.

The Manufacturing Perspective. One only has to glance around to see how technology has influenced our lives. Televisions, VCRs, CD players, hairdryers, air-conditioning systems, microwave ovens, and automatic coffee makers using materials and technology unavailable several years ago are now commonplace. Microcomputers, fiber-optic tele-communications, surgical lasers, new medicines from biogenetic research, and robotic engineering systems are going through second and third generation changes, yet they are products with nomenclatures that have been in our vocabulary for barely a decade.

Someone, or some team, initially challenged the status quo to develop each of these products, and behind each useful product are hundreds, perhaps thousands, of inventions that provided the technological foundations for new products. In each instance, industrial producitivity made quantum leaps through the innovation process of developing these products and, in trun. The products created greater leaps in industrial productivity. More important, these innovative product came about only through extraordinary changes in process technology, the means and methods for manufacturing products. Machines were necessary to manufacture a microchip the size of a pencil eraser, and methods for creating the silicon wafer had to be developed. In addition, the development of testing equipment, materials, handling mechanisms, assembly tools, and remarkable design instrumentation had to precede actual manufacturing.

Individuals behind this vast array of modem technology include corporate research and development scientists, college professors, graduate engineering and science students, and an invisible cadre of "tinkerers" working in basements, garages, and home workshops. Corporate efforts, such as development of the transistor at Bell laboratories emerged after world war II, and the war itself opened opportunities for innovations. Edwin H. Land, a college professor and physicist, had worked on military optical equipment, then turned his attention to processes for polarized light and launched Polaroid Corporation in 1948. William Hewlett and David Packard started their electronics testing equipment business, Hewlett-Packard, in a garage in 1939. They developed the first cathoderay tube (known today as the CRT), which led to hundreds of new monitoring and testing devices after the war. Another prewar contributor, Chester Carlson invented xerography in 1938 paving the way for Xerox Corporation to introduce commercial photo-reproduction equipmentin 1959.

It is amazing that in 1986 nearly 70 percent of all known inventors, scientists, and researchers responsible for the totality of humankind's technical knowledge were still alive. Most are still alive today, and they are not necessarily old. Mitch Kapor (Lotus Development Corporation), and Steven Jobs and Stephen Wozniak (cofounders of Apple Computer Corporation) are all still in their 30s.Complementing the Americans are cadres of foreign entrepreneurs with similar profiles. Bas Alberts, age 34, developed PIE Medical in the Nitherland through the invention of a scanner that uses sound waves to probe parts of the body X-rays cannot reach. His equipment has led to profound changes in medical diagnosis. Alan sugar, age 40 , heads "Amstrad a consumer electronics manufacturnig firm headquartered in Britain that has revolutionized low cost VCRs, tape decks, and personal comoputers. Frances Catherine Gassier, at 27, is a rising star heading Chemi Probe, a biotechnology maunfacturing firm with medical produxts positioned in the European hospital market.

Implications of Productivity

What has happened in agriculture and manufacturing is a rapid evolution in techniques of farming and production that have resulted in extraordinary productivity improvements. Fewer people are involved in direct labor in either economic sector today than in the past because fewer people are needed to produce equivalent results. These productivity gains are particularly apparent in developed Western nations where surpluses of food and consumer products exist. It is equally apporent that these gains have nof taken place in Communist bloc countries such as those in Eastern Europe, China, and the Soviet Union, where food and consumer goods must be imported. Following, the unprecedented change in eastren Europ at the beginning of 1990. it became apparent to new governments in poland, East Germany, Rumania, and the Soviet Union (under Mikhail Gorbachev's domestic reform initiatives) that their priorities for the 1990s were to center oil agricultural reform and manufacturing developments.

The implications of an evolution in productivity in free-market economies, as well as the revolution in productivity needed in socialist-based economies, center on entrepreneurial opportunities. 1-Example cited in the first four chapters of this text and arguments presented earlier in this chapter testify to contributions made by entrepreneurs to technological development.Their efforts transformed our agrarian Western economics into industrial states, and more recently, their efforts have begun to transform the nature of our industrial states from labor-intensive manufacturing to technology-driven economies. Without a doubt, these transformations will occur in Eastern bloc countries that have begun to reassess their priorities, both domestically in terms of productivity and globally in terms of economic trade.

As the 20th century closes, there are extraordinary opportunities for new products, processes, technologies, and services needed in Eastern Europe, Pacific Rim countries, and developing nations in Latin America, Africa, and the Middle East. The opportunities are limited only by one's imagination. For example, with an awakening free press in Rumania, new means of producing and distributing magazines and newspapers are needed, and in East Germany, the unshackling of the media means a proliferation of television programs, stations, television sets, and transmission capabilities. In the Soviet Union, the world's largest McDonald's (a paragon of free enterprise) is setting world sales records in Moscow. What other market-driven enterprises will follow?

Although these are exceptional opportunities born of extraordinary events, there are equally exciting opportunities at home. Agriculture will continue to be a challenge for new products and new technologies in food-growing processes as long as population continues to expand. Productive farmland in the United States is being replaced by cities and highways, requiring new methods of converting arid wastes to agriculture. Water has become a critical resource in America, and there is a pressing need for new farming techniques, water control processes, and urban water technology to serve expanding cities. American consumers are affluent, yet housing systems and technologies are archaic, and a revolution in construction is likely to occur, with new materials and home building processes emerging. And of course, information technology is only beginning to find its way into consumer products,homes, and industrial production techniques.

The current state of computational technology grew from advances in wiring, vacuum tube development, mathematical, artificial languages, mechanical adding and discoveries in processes. There is no reason to believe that we ha*ve reached the zenith of information technology knowledge; perhaps we are still only in a stage of infancy. What will evolve in the next few years or decades is beyond imagination. What is certain, however, is that intrepid entrepreneurs will spearhead those changes and, more important, that most changes will evolve through thousands of new products, processes, and technologies with incremental utility and little fanfare.There will be breakthrough sensations such as the transistor, but most will be unheralded innovations (nonetheless important) such as a water-retention agent for semiarid farming or a biodegradable beer can to reduce solid waste. Consequently, the macro view df industrialization will continue to focus on revolutionary changes such as the emergence of information technology, but the vast number of opportunities exist at the micro level of independent endeavor to "build the better mousetrap."

PRODUCTS AND TECHNOLOGY

At both the macro and micro levels of innovation, few products require exceptionally sophisticated scientific knowledge. Sensational new products occasionally make-headlines, but most are not high tech in the sense of having historic significance to humankind, such as Edison's light bulb. Periodically, major inventions or discoveries emerge that are vitally important; the transistor inspired new industries and technological applications impossible with conventional electronics.

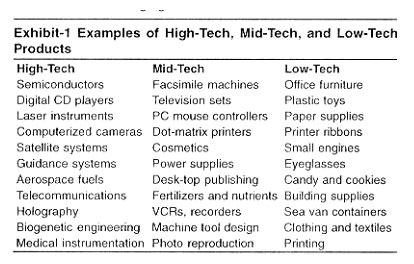

A majority of new products, however, will evolve at the other end of the technology spectrum as low-tech orno-tec/?innovations. Recent examples include no-glare sunglasses, jogging shoes, automatic coffee makers, and interesting games such as Trivial Pursuit. Between the extremes, there are products that require moderate expertise or special resources but are themselves uncomplicated. We conveniently call these mid-tech products. Examples include desk-top publishing software, appealing newspapers such as USA Today, ergonomic chairs, exercise machines, and keyboard synthesizers.

High-Tech Products

A high-tech product is more a state of mind than a discerhable entity, but calling something high tech is useful for describing products that currently reflect state-of the-art technology. Products we call high tech today might be considered part of our "rust-bucket" technology tomorrow. Edison was certainly engaged in high technology for his era when he fashioned a carbon-filament light bulb, but that was long ago.

More recently, the vintage microcomputer, revolutionary at the time, has passed into a "mid-tech" stage where it can be reproduced (cloned) in back-alley Asian factories.

The world of high technology promises breathtaking challenges for youthful entrepreneurs willing to pick up the gauntlet. As we go to press, for example, digital audio systems are coming onto the market. Digital technology threatens to make obsolete nondigitalized CDs, which replaced those old cassette tapes, which in turn made LP albums obsolete. At the same time, an enterprising group of entrepreneurs in Sunnyvale, California, has developed a laser stylus using analog signals carried by reflected light to "read" records without friction. The new laser stylus may soon make existing electroinechanics used in stereos obsolete. Neither digital systems nor lasers were considered useful in commercial audio systems as the 1980s began; both will probably be replaced by more sophisticated systems before the next decade expires.Someone will develop these products; others will commercialize them; and still others will render them obsolete.

Mid-Tech Products

A majority of familiar products are less sophisticated and more readily understood than high-tech innovations, and we classify them as mid tech. An insulated storm window, for instance, is easy to understand. It consists of two or more panes of glass fabricated in to a framed unit and manufactured to close specifications to assure reliable insulation. The technology required to fabricate the storm window is much more complex; it requires special machinery, skilled workers, and efficient manufacturing processes. Many existing products have new or unusual (but farfrom "high-tech") applications. For example, Velcro-that familiar bristles-and-fuzz fastener-has an industrial-strength cousin. The new Velcro fastener is made with small metal hooks rather than bristles. The hooks look like hundreds of very small Js with arrowheads on a metal pad manufactured in much the same way as small integrated circuits.The new product requires a force of more than 100 pounds per square inch to pull apart, and it strong enough to replace most ordinary metal fasteners (screws, rivets, and bolts). The next generation of clothes washers and dryers may be "stuck together" with strips of metal Velcro, and it will not be long before an enterprising designer creates a "Velcro-separating" tool for repair work.

Mid tech, also a state of mind, assumes new uses of existing resources, or methods of production that result in new products. This category might also include commercialization of existing technology that evolves through proprietary knowledge. Differentiating high-tech from Mid-tech products is largely a matter of perception, but unlike high-tech products that presume application of new knowledge, mid-tech products can often be fabricated through adaptation of existing knowledge. Consequently, entrepreneurs need not be inventive geniuses to pursue mid-tech innovations; they only need to be clever in developing methods to use ideas or resources in beneficial ways.

Low-Tech Products

Perception also plays a role in defining what is meant by low tech, but we assume a rather unsophisticated viewpoint. Low-tech products are usually thought to be marginal changes or improvements in existing products. For example, using sheets of plastic and molds, it is not difficult to create boxes to hold floppy disks. With the same materials, most of us could fashion paper trays, desktop pencil holders, VCR tape racks, nad so on. Yet someone had to pull the resources together to manufacture these products. Someone had to design the boxes, trays, and racks, and someone will improve upon them.

Paul Bush, president of Bush Industries, a New York firm that makes computer workstations and a successful line of wooden furniture for electronic products was nearly bankrupt a few years ago. He took over a second-generation family business in wood and plastic products, began with zero cash and "negative assets" of nearly a million dollars, yet within six years had created a powerhouse company. Success came with the same workers, the same facilities, and the same materials that nearly broke his father's firm. The difference was that Paul Bush introduced new products with innovative designs to provide customers with useful furniture.

During the 1960s, cargo ships were laboriously loaded and unloaded with slow, expensive bulk-loading equipment. A dock worker designed the first prototype cargo container as an experiment to reduce item by item loading. This innovation led to improved security and rapid freight packaging. Today "containerized" shipping is the norm. In 1965, Tamon Iwasa, a young Japanese worker tinkering with glass beads, developed the highway reflector so common today. The reflector catches and reflects headlight glare to guide motorists better at night and in foul weather conditions. During the first several years of use in Japan, the Iwasa reflector reduced that nation's accident rate by more than a third. Other low-tech innovations include such common items as disposable razors, butane lighters, felt-tipped pens, and pop-top cans.

Low-tech product development still requires insight by entrepreneurs to see opportunities, and although the resulting products are often short-lived, they represent a vast affay of most consumer goods.They are short-lived because the lack of skill or technology used in manufacturing makes it easy for new competitors to emerge, or for the existing products to be replaced with slightly improved items. Nevertheless, even in high-tech industries like computer-systems manufacturing, thousands of lowtech products are needed to enhance workstations and to provide computer users with desks, trays, diskette cases, storage bins, printer ribbons, files, and so on.

The low-tech entrepreneur focuses on products that can be made easily, marketed quickly, and terminated with a minimum of effort. The last point is important because low-tech products can seldom be protected by patents, and they can be copied or replicated easy by competitors.

IDENTIFYING OPPORTUNITIES

In a free-enterprise system, markets arise for new products and services from wants and needs of consumers. In each of the examples noted previously, the entrepreneurs identified opportunities based on both wants and needs. Paul Bush, for example, recognized that electronic products had to sit on something; home consumers wanted practical television stands, VCR cabinets, and desks designed for microcomputer workstations. However, consumers wanting such products would not have been sufficient to launch a multimillion dollar business; customers also had to need them. Bush invested heavily in market research and found that existing products (such as television stands) were often flimsy and ugly. He also found that few companies made computer workstations, and that a large gap existed between functional metal tables (modified typewriter stands) and fashionable office furniture designed specifically for word processors and personal computers. Paul Bush recognized the opportunity and created his product line.

Sea vans and containerized shipping grew from the want of lower-cost global freight and the need for rapid on-shore handling. As peter Drucker emphatically pointed out, American shipping had almost disintegrated before container systems evolved. Cargo ships were efficient, but the total system of shipping was unprofitable; the high costs of shipping cargo were not incurred in the actual transoceanic transport but in dockside storage and handling. A simple metal container resulted in an integrated system of moving and storing cargo on ships, railcars, and trucks.

Yet another example is the plastic template that can be slipped over a microcomputer keyboard for quick reference to keyboard functions. Templates provide PC users with fingertip information about keys and functions for various software applications. The opportunity gap was one of useful knowledge. Software developers have created exciting applications from word processing to computer-aided design, but learning to use these applications usually means wading through a thick manual written by engineers. Plastic templates help make systems more "friendly," yet they are only printed sheets of plastic costing pennies to make.

Generating Product Ideas

Every person has tremendous experience with a wide array of products and services.We store knowledge far more complex and in quantities that far exceed the capabilities of even the most sophisticated computer system.Yet when students in an entrepreneurship course were asked to brainstorm new product ideas, 35 students representing nearly 735 total years of consumer experience sat numb (and mute) for the first two weeks of the course. With a bit of nudging, however, they formulated a rather impressive list of ideas. They were given an assignment to identify and explain the commercial viability of at least ten new products during the third week of the course. As a result, students identified nearly 800 product ideas-more than one for each year of each student's life.

How did these ideas evolve? For some students, it was a matter of asking critical questions about how to improve things. In one example, a student listed 15 ideas about kitchen improvements while reading a mail-order catalog at her kitchen table. Most of her ideas were unrealistic, but at least she questioned the status quo. Another student listed 18 ideas ranging from new toys to computerized advertisements that could be put on floppy disks. His ideas were triggered by newspaper ads, a shopping trip, watching his younger brother set up a mock war with toys, and trying to jot down a phone number from a television ad. The champion list maker identified 47 ideas, and she turned three of them into money-makers of a student club. Her first success was a colorful wall poster depicting the university. Another was an interactive data base for student housing rentals. The third was an appointment booklet for students, much like the popular Day-Timers except that page formats were printed to coincide with class periods and the university calendar.

These were not earthshaking ideas, but they were moneymakers, and although undergraduate business students are more likely to conjure up low-tech ideas than sophisticated technology, they engage the creative process in much the same way as great inventors.The students identified products by observing their surroundings and consciously questioning how to resolve problems familiar to them. The same exercise was assigned to MBA students at the Chinese University of Hong Kong, and because of their proximity to China, 17 of the 19 students proposed products that could be traded in China. As mentioned earlier, there are global opportunities for inspiration, and these are limited only by one's sensitivity to changes taking place. Often it is a matter of simply doing a bit of library research.Government agencies regularly publish ideas that have evolved from publicly funded research.These products are in the "public domain open to anyone who has the tenacity to pursue their commercialization. For individuals with some financial resources, many inventors are willing to sell out quickly; lacking either the money or the entrepreneurial drive to pursue their ideas, they may advertise, list their inventions with brokers, or write about them in business or technical publications.

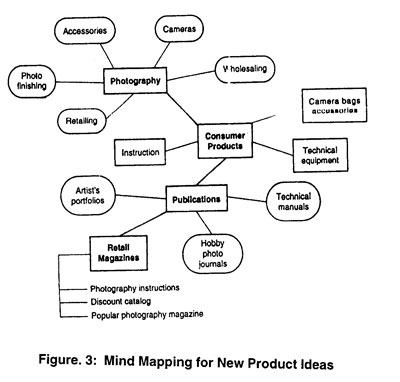

Mapping New Ideas

One way to develop innovative ideas is to mind-map. This is a method of brain storming in which a general idea is refined into components that represent markets, and from those components, product ideas are evaluated for their value to a particular customer. Group decision making techniques, such as Delphi and the Nominal Group Technique (NGT), have less meaning for entrepreneurs who usually find themselves making individual decisions, yet a mind-mapping process can have interesting results.

The first stage of the mind map is to develop likely areas of product or market interests related to an entrepreneur's general business interest. In the illustration, the entrepreneur was an amareur photographer interested in turning a lifelong hobby in to a business. From the first stage, she identified "cansumer products" as being of more interest to her than other options. From the fours of consumar product she extended her ideas to specific products or services, including camera bags, developing photography-instruction seminars, designing technical equipment for professional photography, and creating publications on -photography.She selected the area of publications to explore, and in the third stage she identified several related business opportunities. Being an avid writer as well as a photographer, she quickly narrowed the field to three types of magazines that would interest her. She researched ail three, and eventually decided to create a photography instruction magazine aimed at photography hobbyists and parents.

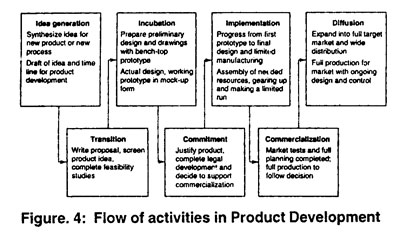

THE PRODUCT DEVELOPMENT PROCESS

The product development process is an extension of the general model of innovation. There are essentially five stages in the model: idea germination, preparation, incubatiog, illumination, and ver/f/caf/on.The product development process is more detailed and uses different terms than the general model of innovation. Figure 4 illustrates the activities of product development based on an expanded model. A product evolves through this serial process, and product development can be terminated at any point.

The Idea Generation Stage

The idea generation stage is the conscious identification of a product idea that logically addresses an opportunity. An opportunity is defined as the identification of a gap in "need" and the likelihood that if a product were developed to fill that need, it would also be "wanted" (i.e. there would be effective consumer demand). This idea may be born of entrepreneurial insight, creative mind-mapping, or accidentally stumbling upon an idea through a corridor of related activity.

It is one method by which many products are born. For example, when Karstan Solheim first developed his revolutionary Ping golf putter, he had no concept of an entirely new design for golf irons, but the "toe-and-heel weighted" putter worked so well that he experimented with a similar design for all golf clubs. This corridor in golf equipment design led to a new way of manufacturing golf clubs using new lighter weight materials, and today every major golf manufacturer is making so-called game improvement clubs fashioned after Solheim's innovation.

Giving an Idea Form. Once an idea has begun to gel, the entrepreneur must set it down on paper, design it, and if appropriate, make a "bench model." For simple products, a bench model is possible. For example, an early model of an electric toothbrush consisted of four dry-cell batteries linked with yards of wire to a toy motor that had a welded metal toothbrush attached. It looked more like a child's experiment than a product. But the point of the bench model was to identify how the product could work. This model gave the designers some form of product on which to build a proposal. Often an idea has no form at this point, and the idea is little more than a concept. For example, a new software program may have no greater degree of development than a rough flowchart of what the software could do. It is still important to get it down on paper.

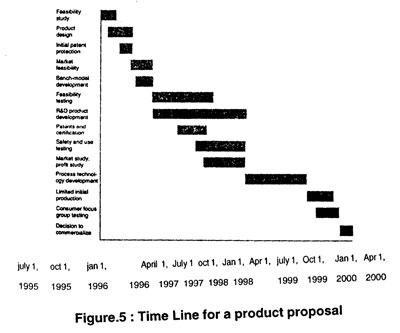

Justifying Further Development. The critical milestone activity at this point is writing the proposa/to proceed with product research. Working with a bench model, sketches, notes, or flowcharts, the designer-entrepreneur must plan the development process. If this development takes place through corporate R&D, a model of intrapreneurshipsuggests that designers write a program proposal showing how the first-stage model will be systematically built into a working prototype. If an entrepreneur is working solo, he or she may write an initial proposal to attract seed money. In either case, the proposal should include estimates of development costs for materials, labor, engineering assistance, special equipment needed, and so on. The Proposal should also have a time line specifying how work will proceed and when the developers will have a testable prototype.

Transition to the Next Stage. If the proposal is made through corporate R&D, it must be accepted and funded. If management cannot share th same vision of success as the innovator, the product maybe terminated without fanfare. If the product seems promising but the proposal is weak, the innovator may be pressed to rewrite the proposal and further justify development plans before approval is given. In the case of a solo entrepreneur, the project may die on a loan officer's desk for lack of funding or, alternatively, it may die for lack of investment capital.

The risk of losing support and funding can be reduced if entrepreneurs consciously seek advice before presenting their proposals. This intermediate step is called screening, a step not often taken seriously by most aspiring entrepreneurs, yet a step that can be of enormous help.

Screening the Product. Screening procedures exist in larger organizations whereby a product is submitted to a formal survey among key managers and engineers.The screening process is a subjective evaluation that relies on expert opinion of a select group to rate the proposal for ito comniercial feasibility. Several years ago, the National Science Foundation created a formal "innovation evaluation process" (IEP) that io now available through more than a dozen university centers. For a small fee, the university will assemble a panel of experts who rate a product on 31 criteria ranging from physical development feasibility to market potential. The IEP panel also assigns a probability for success and compares several thousand IEP case studies to give an entrepreneur some measure of validity for the panel's recommendations. Investors and lenders who know about the IEP look favorably on an ntrepreneur who takes the initiative to have a formal screening evaluation completed.

The Incubation Stage

Having survived a screening process and obtained funding, the innovator must set about implementing the first stage of actual product development. The product must be devised and a prototype developed.

Product Design.Traditional R&D will follow a prescribed path of turning rough sketches into blueprints. These will be expanded into material lists and a plan for making one item-a prototype. The prototype is usually built without the aid of production-level, equipment, in expensive process based on custom development of one working product. Ideal materials may not be used, tooling may be a bit rough, and the product may be a bit awkward, but it must closely approximate the end product envisioned by the intiovitor. This stage of development is often a frustrating period of creating numerous failures. Edison madeat least a thousand light bulbs they did not work. When questioned about this, Edison said that he had not failed but had discovered a great many ways in which electricity would not work. Success would come only after numerous redesigns, new prototypes, more failures, and finally a feasible product.

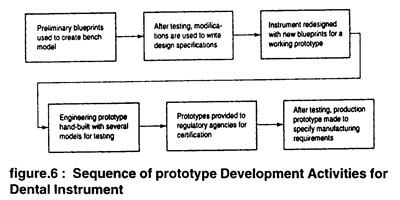

Making the Prototype. Assuming the innovator has endured the failures and has a design that finally seems workable, a prototype is built and submitted to testing. This stage of development can be quite lengthy and include having several prototypes field-tested under government supervision (or by approved laboratories) to comply with government regulations. For instance, a new dental instrument may have to be tested by an approved "principal investigator", a qualified dental researcher who runs feasibility tests, rates the instrument's safety, attests to the instrument's used fulnessm and writes an opinion for review by the food and drug Adminisration (PDA). The same dental istrument may have to pass certification tests by the National Institutes of Health (NTH) and conform to safty ratings through an approved laboratory.

Market research is usually not pursued at this point. Market tests are reserved for the third stage when a product his undergone some limited manufacturing gained patent protection, and had other Ie9al groundwork laid such as registration of trademarks or documentation of copyrights. However, during this second stage of inclubation, testing is important to establish a product's feasiblity and to flesh out specifications so that patents, trademarks, or copy rihgts can be pursued.An actual sequence of events for developing a dental instruments protoye is shown in figure 6.

Financial Resources For New Ventures

Financial resources are essential for business, but particular requirements change as an enterprise grows. Obtaining those resources in the amount needed and at the time when they are needed can be difficult for entrepreneurial ventures because they are generally considered more risky than established enterprises. As we shall see, financing means more than merely obtaining money, it is very much a process of managing assets wisely to use capital efficiently.